The United Way of Lackawanna and Wayne Counties is approved by the Pennsylvania Department of Community and Economic Development as an Educational Improvement Organization (EIO), Pre-Kindergarten Scholarship Organization (PKSO), Scholarship Organization (SO) and Opportunity Scholarship Organization (OSO, and we are proud to say that we led the way as one of the first United Ways in Pennsylvania to receive this designation. Thanks to the generosity of 18 local companies contributing more than $410,000 in tax credits last year, hundreds of children from Preschool to High School are on the path to a bright future. Read more about our Innovative Educational Opportunities and Pre-K Scholarships as a result of this program.

Eligibility

Businesses authorized to do business in Pennsylvania who are subject to one or more of the following taxes:

- Personal Income Tax

- Capital Stock/Foreign Franchise Tax

- Corporate Net Income Tax

- Bank Shares Tax

- Title Insurance & Trust Company Shares Tax

- Insurance Premium Tax (excluding surplus lines, unauthorized, domestic/foreign marine)

- Mutual Thrift Tax

- Malt Beverage Tax

- Retaliatory Fees under section 212 of the Insurance Company Law of 1921

How Does My Business Apply?

How Does My Business Apply?

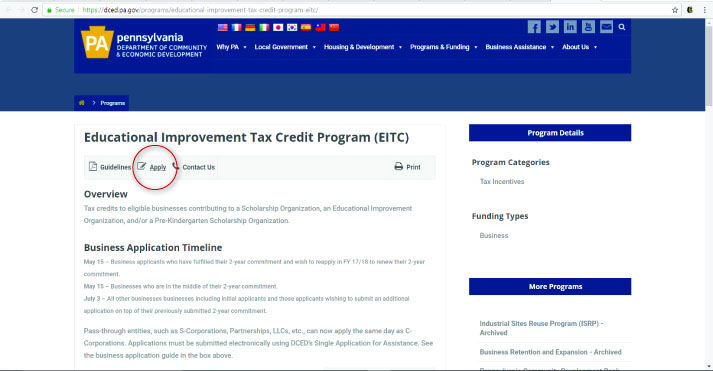

Pennsylvania businesses can begin applying for EITC credits through DCED’s electronic single application system. DCED will no longer require applicants to mail the signed signature page.

The business application guide on the PA DCED website explains the process of applying. Tax credit applications will be processed on a first-come, first-served basis by day submitted. All applications received on a specific day will be processed on a random basis before moving on to the next day’s applications. Applications will be approved until the amount of available tax credits is exhausted.

What is the timeline for Business Applications?

- May 15 – Business applicants who have fulfilled their 2-year commitment and wish to reapply in FY 19/20 to renew their 2-year commitment.

- May 15 – Businesses who are in the middle of their 2-year commitment.

- July 1 – All other businesses including Pre-K business applications. Beginning July 2, 2018 business firms may agree to provide the same amount of contribution to a Pre-K Scholarship Organization for two consecutive years.

- If you applied and received Pre-K approval for two years in 2018, you may submit your application beginning May 15th.

Funding

Tax credits may be applied against the tax liability of a business for the tax year in which the contribution was made. Tax credits equal to 75 percent of its contribution up to a maximum of $750,000 per taxable year. Can be increased to 90 percent of the contribution, if business agrees to provide same amount for two consecutive tax years. For contributions to Pre-Kindergarten Scholarship Organizations, a business may receive a tax credit equal to 100 percent of the first $10,000 contributed and up to 90 percent of the remaining amount contributed up to a maximum credit of $200,000 annually. (An additional $750,000 in Opportunity Scholarship Tax Credits {OSTC} may also be available.)

Important Terms

An approved company must provide proof to DCED within 90 days of the notification letter that the contribution was made within 60 days of the notification letter. Tax credits not used in the tax year the contribution was made may not be carried forward or carried back and are not refundable or transferable.

Questions?

- Visit the PA DCED website

- Contact John Orbin, United Way's Vice President of Resource Development/Campaign, 570.343.1267 x234

- Contact Salvatore R. DeFrancesco, Jr., CPA CGMA, Executive Vice President and Chief Financial Officer of Fidelity Bank and Chair of the United Way's EITC Program, 570.504.8000